Mergers and acquisitions hold promise for owners and investors of combinatorial synergies to reduce costs, increase profit, extend market and product coverage, as well as accelerate innovation.

2020 has been a banner year for mergers and acquisitions, with 5500 deals so far. This record volume may be partially due to the Covid-19 outbreak forcing the liquidation or disposal of underperforming non-core or struggling investments. However, mergers come with a great deal of risk as reflected in failure rates that are reported to be between 40% and 70%.

Despite best-laid plans and executive oversight, human factors present the greatest risk and sales-force integration is the toughest merger issue to overcome.

1+1 does not equal 3

In the B2B technology market we have all seen optimistic mergers and acquisitions struggle to achieve projections and prove a lie to the 1+1=3 equation that drove much of the pre-merger thinking. In many cases, the merger actually destroys shareholder value, where 1+1 is less than 2.

In this BCG article A Proven Framework for Post-Merger Integration, the author identifies twelve essential steps to facilitate successful integration. In sales enablement, we are concerned with the post-merger phase:-

-

Design the future operating model early in the process; it may differ from the day-one structure.

-

Manage talent by selecting, retaining, and developing the best people.

-

Rigorously manage cultural integration and change management.

-

Communicate, communicate, communicate; it is better to have too much communication than too little.

My article seeks to explore several of the high risk factors in any merger;

-

Positioning the newly merged entity in a way that is engaging and builds confidence in employees and customers,

-

Getting the combined sales teams productive and marching to the same tune,

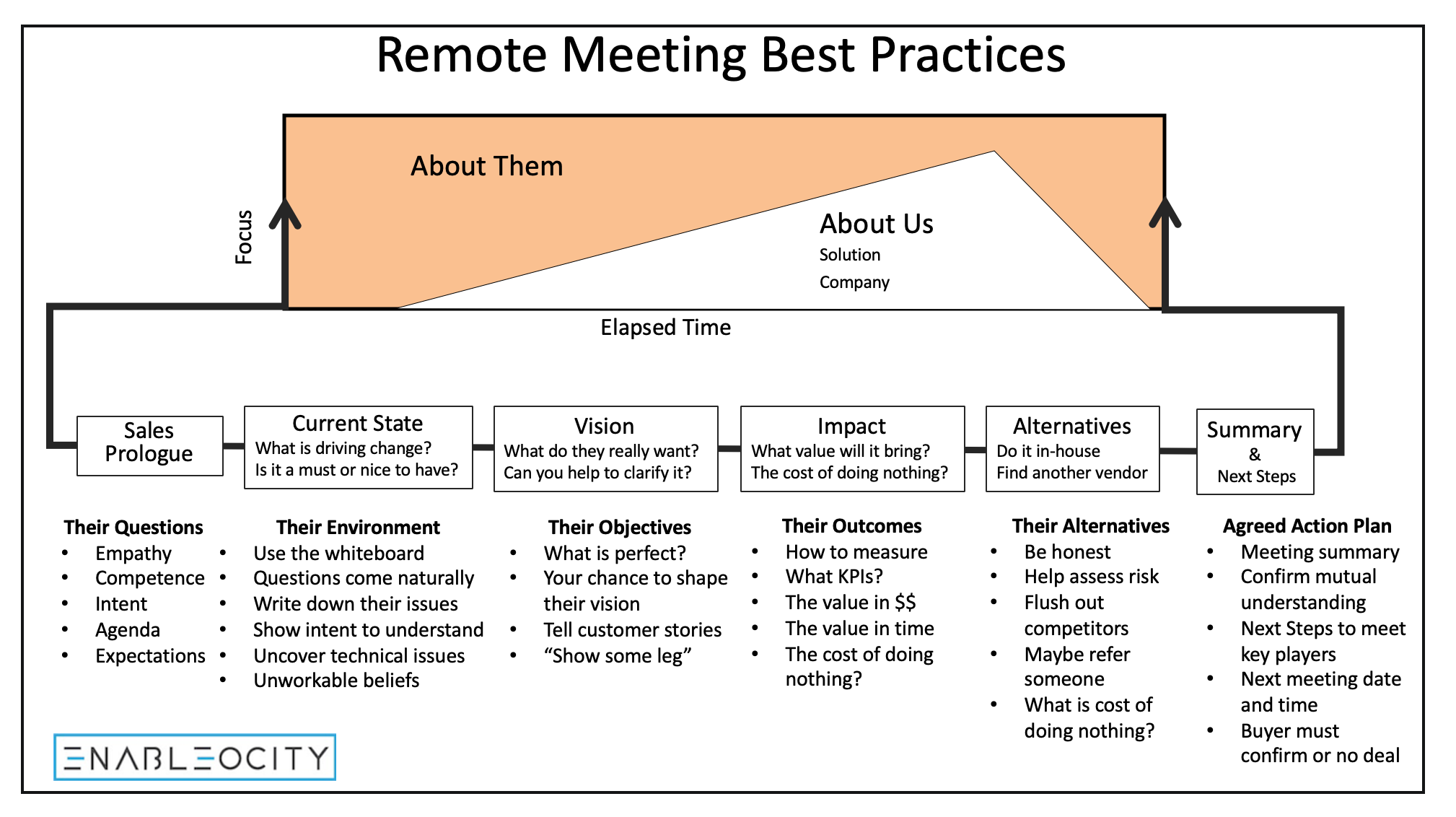

Many post-merger business plans are based on pro-actively cross-selling for the 90-180 day period after the deal closes to generate quick-wins and build confidence and momentum, both internally and in the market; where company A’s sales team is tasked with positioning their own products as well as cross-selling company B’s products into their installed accounts and vice-versa.

However in conversation with sales and marketing leaders in several merged companies in recent months, despite intensive product and sales training and incentives, the merged sales teams have failed to produce forecast results.

In one company I spoke with the VP of product management; company A products are a market-leader and sales are growing as forecast, yet company B’s products which were fast emerging in different market niche, have few leads and fewer sales and heads are beginning to roll.

On closer examination it became clear that there were two key contributing factors that had been glossed over in the pre-merger plans.

1. Product maturity mismatch

2. Selling skill mismatch.

Product Maturity Mismatch

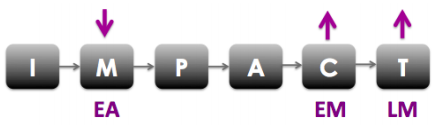

The I-M-P-A-C-T cycle is how B2B companies buy, with or without the help of a sales executive. I-M-P-A-C-T stands for the steps in the buying process, from the initial Idea-Mentor-Position-Assessment-Business Case-through to-Transaction. Company A is a market-leader, much of the new business growth comes from referrals and its business is growing at 30% per year. A buyer of company A’s products is a pragmatic Early-Majority (EM) buyer, the buying category is mainstream, company A has a well-established brand and is considered a safe bet.

Company B however is smaller and fast growing in an emerging market category They sell to Early Adopters (EA) in a Value Created way. It's salespeople are technical and their presentation style hands-on and demonstration-led. Several of their sales stars jumped ship in the first months after the merger, (another big risk in any merger is the top sales and pre-sales stars leaving).

After one year, company A’s traditional customers still view company B’s products as interesting, but risky. The combined sales team struggles with positioning company B’s products in a presentation and demonstration-led sales cycle that takes an hour and is heavily PowerPoint oriented.

Selling Skill Mismatch

Company A has a mature product and its buyers engage sales people in a value-added way at the business case or transaction-end of the buy cycle after they have determined needs and are ready to configure and buy the software.

Company B’s products are still crossing the chasm to the early majority. They sell to Early Adopters, (EA) engaging early in the buy-cycle as buyers see the potential in the products to get a leap on the competitors and are prepared to engage salespeople earlier - in a conversation of possibilities. Salespeople in company B behave more like technical consultants than “gung-ho” salespeople and invest lots of time and technical effort to help buyers to understand the risks in their approach as well as the upside.

This by definition is Value-Created Selling, where the insight of the consultants creates momentum for change and shapes the buying experience. Company B salespeople are successful in winning pilots and they set the agenda for the eventual purchase, however sales cycle times are 6-12 months.

Fans of The Challenger Sale will see an obvious parallel in approaches.

Action Plan for Post-Merger Success:

Human factors far outweigh technology risks in M&A activity. Sales people will not position new products when they lack confidence and are uncomfortable in doing so... they will continue to position what they know and try to make their numbers selling their familiar product portfolio.

Traditional approaches to sales training in the form of a PowerPoint whipping from product management and a sales portal stuffed full of promotional material will not help to reduce sales ramp-times in post-merger situations any faster than with new hires in existing companies.

Message Enablement

Capturing conversational content in sales playbooks in a message enablement exercise is the first priority when the deal is signed. The conversational content to support field and channel salespeople and SE's must be harvested and curated through a digital editorial process and should be made available in digital sales playbooks, accessible via smartphone, tablet or laptop whether on the phone, in email or Salesforce.com.

Salespeople shouldn't have to look for the content they need to plan a call or that they need in a call or to followup a successful call. Tacit or tribal knowledge that the top sellers and SE's have acquired should be tapped and shared to ensure rapid-ramp of the sales team selling the new products.

Talent Enablement

Traditional product training is a waste of time and doesn’t work. Post-merger sales talent enablement requires virtual immersion in role-playing the key customer conversations. Reinforcement through gamification and spaced-repetition post-classroom. There are several objectives here;

i. to teach salespeople to use the content in the playbook, and

ii. to understand the extent and the value of the knowledge captured in the sales playbook.

Sales playbooks must be launched in immersive roleplaying workshops combined with sales management coaching, reinforcement and certification. Usage monitoring and promotion of high-value content is required to drive adoption and successful playbook launch, post-acquisition.

One approach to ensuring conversational content is mastered and salespeople develop situational fluency is through iterative visual storytelling. Visual storytelling is also extremely effective in helping salespeople to communicate their "big idea" quickly using visual confections when time is short.

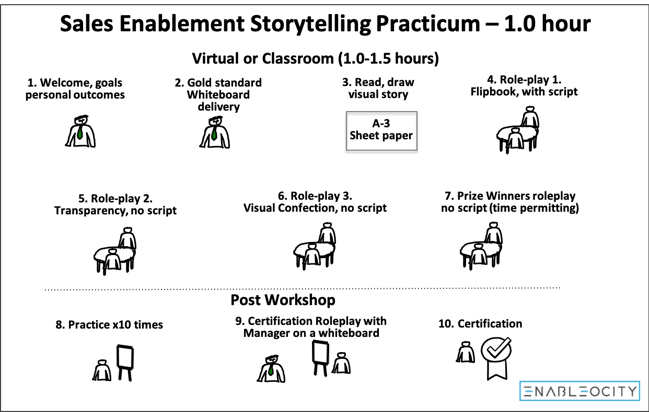

We have innovated on the storytelling process and can now deliver a virtual visual storytelling and animated storytelling training session in as little as 1-hour. This will extend beyond the hour if there is a competitive prize-winning round. This is often all that channel partners will set aside for vendor training, only instead of a PowerPoint whipping channel salespeople experience three different visual storytelling approaches and know the story by the time the workshop concludes.

Post training reinforcement, coaching and competency certification will drive behavior change to help achieve sales integration and revenue targets.