I have read some really important books this year that expanded my view of the World and gained valuable insight and I wanted share my top reads in 2009 with you and include links to either Amazon or to my reviews. Please feel free to recommmend any of your favorites that have a base in science and serve to expand our understanding of the sales and marketing sphere.

4 min read

Holiday Reads for Hi-tech Entrepreneurs, Marketers and Salespeople

By Mark Gibson on Wed, Dec 16, 2009

Topics: inbound marketing killer products book review

2 min read

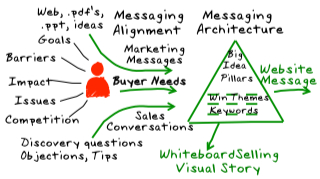

A Marketing Messaging Guide to Effective Sales Conversations

By Mark Gibson on Mon, Dec 14, 2009

The marketing messaging used in Websites and Blogs to drive Inbound Marketing leads, must be used to drive sales conversations with the gamut of prospects and customers, without salespeople having to translate it or figure it out themselves.

Rules for Inbound Marketing Messaging:

For a B2B Internet Site to be effective, there is more work required than simply selecting and optimizing keywords. Effective Website messaging and blogposts have the following characteristicsTopics: killer products consultative selling value creation

7 min read

Recruiting SaaS B2B Sales Channels and Getting Sell-through

By Mark Gibson on Wed, Sep 09, 2009

This is a hot topic - not only for the new cohort of SaaS solutions providers, but for every entrepreneur with visions of channel sales success as well as medium sized companies wanting to sell innovative products through an indirect model.

Why Channel Sales?

The fundamental question is - why do you want to sell through channels?Let’s assume you have some really strong business reasons for wanting to sell through the channel and everyone in your company, including the investors, is on board with the idea.

Before proceeding, please ask yourself the following four questions.

- Is your direct sales process fully optimized, to the point that you have identified your own best practices and everyone on the direct sales team sells the same way?

- Are you generating more inbound leads than you can handle meaning sales people spend all of their time speaking to interested prospects (inbound leads) who find you on the Internet -and are not cold calling or working on telesales developed leads?

- Is your product fully-baked, to the point where the code is stable, you have an SDK, standards-based API and fully documented instructions on how to extend and integrate with your product?

- Are your existing customers raving fans of your product?

Based on this experience I suggest that if the answer to all four questions above is not a resounding “yes”, then you are probably not ready to sell through channels. I coined the phrase “when you are truly ready, the channel will show up”, based on years of direct work with and observation of how the vast majority of channel partnerships actually work.

Trying to move channel partners in a specific direction before either they, you, or more importantly, the market is ready, inevitably leads to wasted effort, cash and disappointment.

Now let’s assume you already have a committed channels plan in place, you have dedicated resources and a number of channels partners signed up, and like thousands of companies worldwide - your program stinks.

When I speak with CEO’s, they routinely point to weak channels as their number two problem in their B2B sales and marketing groups, right behind the top problem of insufficient qualified leads.

So how do we come to grips with the harsh realities of today’s market, the overall capabilities of channel partners and what we should really expect from them? The remainder of this post will provide some insights and recommended tools that you can use to actually improve channel performance:

Selling to the early market

First and foremost, is your product, service or solution based on a novel or discontinuous technology? If not, is it an evolution of an existing product or technology in an established market? The answer to this question is crucial.

• If your product is novel and truly disruptive, go back and answer the first four questions.

• Now that you have answered the questions again in your own mind, is there an established buying category and have your products been accepted by the early majority (mainstream market) or are you still selling to the early adopter market and trying to get across the chasm?

- If you are across the chasm and into the early majority, please go to the next question

- If you are selling to the early market then you will need your channel to sell the way the early market wants to buy. The early market buys differently from the mainstream market and it is a "value-created" or consultative sell.

- The "Technology Adoption Cycle vs. Risk" animation is adapted from our Selling in the Internet Age training course IMPACT Buying Concept.

- Most channels sales teams are geared for "value-offered" or "value-added" sales models and simply don’t understand how to, or have the skills to sell novel technology to early adopters.

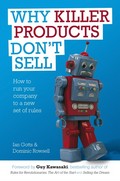

- This mismatch in the early market "value-created" buying culture vs. the way the typical channel partner is selling (value-offered or value-added) is the biggest reason why so many channel partners and programs fail. Follow this link to a discussion on why value-created selling is key to penetrating the early market. You might want to have a discussion with your direct sales team on this topic as well and buy a few copies of the book Why Killer Products Don't Sell.

Selling to the Mainstream Market

If you’ve made it and sold your way across the chasm, congratulations are in order as this is a fantastic achievement for any business. If you're positioning a new product in an established buying category, with established competitors then you face another set of interesting challenges:- How are you planning to, or how did you acquire your existing partners?

- Do they fit with where you are today and where you need to go?

- What relevant training and support have you provided for them?

- Have you developed your own Messaging to raise the standard of conversations your direct sales team has with target buyers and to differentiate your product vs. competition and, more importantly, have you trained your partners to use it in role-playing situations?

- Don’t expect the channel sales team to figure this out on their own. Most have other products in their portfolio to sell and they are probably more comfortable doing so.

- Channel sales performance is a direct result of how easy you make it for their salespeople to position and sell your product and the market demand for the product class.

- If all your channel have is a PowerPoint, brochures and a price-list parked on a portal somewhere and distant memories of a ½ day product pitch from your product management team, then you will fail.

- Have you planned to collaborate on lead generation programs and have you shared leads with them?

- Have you gone on their first half dozen sales calls to give them feedback and coaching on their sales calls?

What channels sales people need to be successful

If you plan to spend as much or more effort on training the channel to sell as you do your direct team, then this is a good equation. In the post-Internet era the value of a 1:1 call with a buyer has risen by an order of magnitude; here are a few suggestions as to what direct and channel sales people need to be successful.

- It starts with a lead and Inbound Marketing is a better way to generate leads whether you are a technology vendor or a channel partner and its 60% cheaper than alternate methods.

- Product-usage training and storytelling around the target-buyer persona, i.e. what are the roles, goals and likely issues your target buyers are having where your products could potentially help and the rationale?

- Read “New Rules of Marketing & PR”. It’s a revelation on marketing to the interests of buyers and relevant for all marketers.

- Product knowledge and how to position relevant capabilities and to diagnose and qualify if these capabilities are relevant

- d. The ability to have the buyer envision using your product and/or service in solving their problem

- e. Understanding and leading the buyer through the value-exchange in using your product and the associated ROI.

- f. Communication, language skills, sales-craft skills and tools for Selling in The Internet Age

- Big Idea narratives and visual confections that tell your story and guide conversations with target buyers, supported by proof points to create a story that engages the buyer, create true differentiation for both direct and channel salespeople

Where the channel works really well

In today’s technology market, there are many great examples of highly functional and well-developed channels. Cisco Systems, Microsoft and Salesforce.com have surrounded themselves with hundreds of thousands of partners that deliver, implement or extend their products and services with a high degree of effectiveness.This primarily occured because all three companies realised that extending their ability to reach a broader audience would best be served though a channel. Except for Microsoft, channel success ocurred after their markets were well developed and beyond the chasm, it was easy for the value-added partners to do exactly what they do best, e.g. add value.

To enjoy the highest level of success with your channel, understand what they can and can’t do for you, equip them to win and set mutual expectations. Most importantly, even though they are not your employees, treat them like they are, invest in training them like they are your own and manage them closely.

Otherwise, don’t be surprised when they fail to deliver.

Topics: inbound marketing killer products marketing messaging

4 min read

Value-created Selling - key to winning the early market

By Mark Gibson on Tue, Jun 30, 2009

What is Value-created selling and why does it matter?

Topics: killer products book review value creation

1 min read

"Why Killer-Products Don't Sell" - Admarco book review

By Mark Gibson on Wed, Apr 22, 2009

1. Firstly, there is original thought in the analysis of the buying cycle and the lifecycle of every purchase in the buying organization. The authors state and I agree that every purchase follows the I-M-P-A-C-T ( Identify - Mentor - Position - Assessment - Case - Transaction) process, the difference is that in a mature buying category, this can happen in a couple of minutes for acquiring a "value-offered" product (Dell Laptop), vs. months for an emerging buying category "value-created" = your discontinuous technology.

2. The second key idea is that there are four different selling cultures, depending on the maturity of the buying category. This indeed explains why so many "proven" sales-people and sales managers from well known corporations (value-added or value-offered) fail in early stage companies where the buying category is still being formed (value-created) and a consultative sales approach is required....this is worth the price of the book alone.

3. The imperative is for sales teams to understand where they are in the technology adoption life-cycle in order to more effectively facilitate the buying process; and for technology sellers to align their organizations operational cultures to match the buying cultures of their target markets.

Dominic Rowsell and Ian Gotts have made a valuable contribution to a growing body of work in the science of professional selling.

We have spoken with both authors and with their permission will be integrating the IMPACT concept and ideas from their book into our Consultative Selling Training courses and E-Learning programs.

Highly recommended!

Topics: killer products consultative selling value creation

5 min read

VC'S Don't Make Bad Investments - How to Sell Killer Products

By Mark Gibson on Wed, Feb 25, 2009

Most VC's will see more than 100 opportunities a year and invest in a handful, representing the combination of best teams, best products, great business cases and a market receptive for the products.

Is this Darwinian or the hidden hand of some great technology creator?

What happened to that great investment?

If the due diligence was correct and the product works and there is a market, how come there are so few stars and so many companies struggling to win new accounts after the founders handed over the selling to the professionals?What if anything can be done about it?

Our business is in improving the performance of early-stage and mid-sized technology companies through aligning sales and marketing messaging around the buyer; creating transparency in sales process; and in teaching people to sell consultatively and to disrupt status-quo thinking.

I was delighted to find and read in "Why Killer Products Don't Sell"by IanGotts and DominicRowsell, a clear and logical explanation of why so many early-stage companies get it wrong.

Symptoms of a problem?

On an assignment in an early-stage software company last week, with the book fresh in my mind, was not surprised to learn they had hired and fired 5 sales people in the prior 3 years - none of them could sell their product.So many companies with novel products make the same mistake. It goes something like this; - after the founders have made the first few sales, the owners decide it's time to hit the gas. They raise a funding round to ramp sales against an aggressive target; hire a sales director and team of proven sales professionals. WARNING!

Did anyone specify these sales people will look more like consultants; that they need early-stage or start-up experience; are comfortable calling-high and having business conversations with senior execs about their problems (consultative selling).

According to authors IanGotts and DominicRowsell, symptoms of the problem are:

- Sales are stalled, you generate plenty of interest, but mainly educate

- Numerous pilots, but no pull through

- Big deals keep slipping from one quarter to the next (value-created customer buying cycles have no connection to the quarterly revenue problem)

- You run out of mates and technology enthusiasts to sell

- Small incremental sales, but no large follow-on orders

- You confuse your customer and you have internal arguments about whether you are a consulting company or a product company...(this is irrelevant, to your customers you are a product company).

A Process for Managing the "Value Created" Buying Cycle

One very clear message from the book for VC's and leaders of early-stage companies is to understand and align with the buying behavior of their customers. "The value-created buying culture occurs when the customer senses there is an opportunity, but can't describe it. It takes the supplier to bring it into clear focus and suggest a solution."Topics: killer products lean startups

3 min read

Adapting Sales Process for Long Term Survival

By Mark Gibson on Sun, Jan 18, 2009

Over the Christmas holidays I took my daughter to the London Museum of Natural History, and among other exhibits, spent a good deal of time in the Charles Darwin Exhibit. Darwin has been in the news a lot lately as it’s his 200th anniversary and there are all sorts of metaphors and lessons being drawn from Darwin’s works.

I was struck by the exhibit and his genius and thought about my industry, the technology industry, and how this closed system has recently undergone violent upheaval. I asked a partner of ours, Barry Trailer co-owner of CSO Insights, (CSO Insights is a research firm that specializes in measuring the effectiveness of today's sales and marketing organizations), what his thoughts were on surviving in the current market, and they were insightful

Barry suggested, “Most companies will simply jettison people in a knee-jerk reaction to reduce cost, but this is not adapting to the new environment. The companies with formal sales process that mirrors the customer buying process, those who adapt their sales process when conditions change, are favored to be preserved while companies with informal or tribal sales process will find it very difficult and may go the way of the Dodo".