The following is a true story. A few names have been changed to protect the identity of some of the people involved.

In the first episode of this story, Scorched Earth, I described the situation leading to my being hired at MicroStrategy into an OEM sales role and the problems in overcoming relationships that had been soured by my predecessor.

In the second episode, Defeat, Adam Zais and I explored the changing fortunes of B2B sales professionals and I describe the events leading up to my being given 30 days notice of termination. This article covers the 90 day lifecycle of the deal itself.

You will recall it had taken more me than 2 years to overcome the scorched earth from my predecessor, execute the joint marketing agreement that led to the value-added reseller agreement, which led to a couple of 7 figure NCR-Teradata-MicroStrategy sales to major US retailers, that saved me at the 11th hour from being fired.

Everything that went before the pivotal meeting with NCR-Teradata in Vienna, VA., in mid 1999 can be described as grunt-work, relationship building, building influence and gathering intelligence.

Selling into a major corporation in B2B, or partnering with a major technology company in an OEM role, is like orchestrating a chess game, - lots of activity with pawns, but nothing of consequence happening without engaging the major pieces. When Rocky Blanton attended our mid-year NCR-Teradata briefing, I knew we had found our major piece, a “Queen” to champion our cause.

Rocky Blanton was VP of sales and senior member of the NCR retail team, - he was also on the NCR-Teradata strategy committee. At our meeting, we reviewed our initial joint success with major retailers and discussed the pipeline of opportunities and the future technology roadmap for MicroStrategy products. It was during the discussion on strategy that Rocky revealed an interest in moving our partnership to the next level, - OEM.

I remember the excitement as we took a break in our meeting and I literally ran down the hall and burst into MicroStrategy COO, Sanju Bansal’s office to tell him the news.

The initial suggestion for a deal came from Sanju and it was for a $5M pre-pay. This did not sit well with me and after 3 years, I knew where all the skeletons and opportunities lay at NCR and felt that there was far greater potential for an accretive deal.

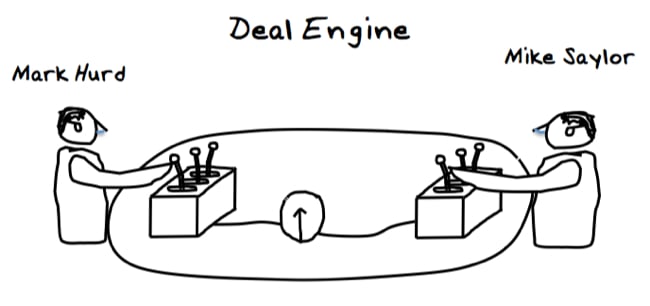

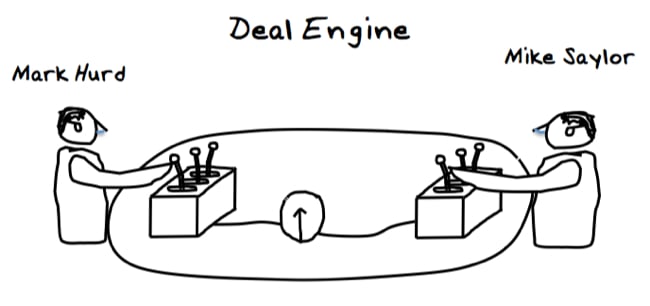

With Sanju on vacation in India the following week, I used the opportunity to pull together an outstanding group of MicroStrategy sales VP’s, Steve Foley, Ray Tacoma and Dan Shoemaker, with MicroStrategy CEO Mike Saylor for a big-deal brainstorming session. I briefed the group on the potential pieces to a deal and the objective was to build a deal-engine with a bunch of levers that we could both manipulate in order to find a best-fit deal.

It was July 1999, the Dot.com boom was accelerating toward its zenith and the landscape for an OEM partnership deal was as follows: -

The first change in the relationship as we started to work on a deal was the appointment of an experienced hand in Tom Crooke to run the NCR side of the deal. Our deal team consisted of myself, Sanju, Mike Saylor, CFO Mark Lynch and our legal counsel, Adam Ruttenberg, with Dan Shoemaker running the scenarios.

Once we had identified all of the deal elements in our deal engine, the roles changed and I became a supporting player as the executive teams on both sides took over structuring and negotiating the deal through a series of increasingly significant meetings in Dayton OH., and over the phone, culminating in the NCR-Teradata – MicroStrategy OEM partnership.

The NCR-Teradata - MicroStrategy partnership was structured as follows;

There were many people who contributed to the success of the OEM partnership and ongoing business relationship. As I mentioned in the first part of this story, in OEM sales, it’s best to park your ego at the door. It’s a long haul, and when success comes, you will be one of many who contributed.

To be continued in Part 4. Aftermath

In the first episode of this story, Scorched Earth, I described the situation leading to my being hired at MicroStrategy into an OEM sales role and the problems in overcoming relationships that had been soured by my predecessor.

In the second episode, Defeat, Adam Zais and I explored the changing fortunes of B2B sales professionals and I describe the events leading up to my being given 30 days notice of termination. This article covers the 90 day lifecycle of the deal itself.

Finding a Champion

Much has been written in B2B sales literature around the need to find a champion for your cause inside the company you are trying to engage. A champion can literally take you to the top of the organization, influence strategy, engage decision makers, acquire funding and make things happen in weeks that could take years, or may never happen without their support.You will recall it had taken more me than 2 years to overcome the scorched earth from my predecessor, execute the joint marketing agreement that led to the value-added reseller agreement, which led to a couple of 7 figure NCR-Teradata-MicroStrategy sales to major US retailers, that saved me at the 11th hour from being fired.

Everything that went before the pivotal meeting with NCR-Teradata in Vienna, VA., in mid 1999 can be described as grunt-work, relationship building, building influence and gathering intelligence.

Selling into a major corporation in B2B, or partnering with a major technology company in an OEM role, is like orchestrating a chess game, - lots of activity with pawns, but nothing of consequence happening without engaging the major pieces. When Rocky Blanton attended our mid-year NCR-Teradata briefing, I knew we had found our major piece, a “Queen” to champion our cause.

Rocky Blanton was VP of sales and senior member of the NCR retail team, - he was also on the NCR-Teradata strategy committee. At our meeting, we reviewed our initial joint success with major retailers and discussed the pipeline of opportunities and the future technology roadmap for MicroStrategy products. It was during the discussion on strategy that Rocky revealed an interest in moving our partnership to the next level, - OEM.

I remember the excitement as we took a break in our meeting and I literally ran down the hall and burst into MicroStrategy COO, Sanju Bansal’s office to tell him the news.

Finding a Deal

The OEM partnership potential between NCR Teradata and MicroStrategy was obvious, even for our customers. The combined toolset was ideal for customers wanting to get answers to SKU–level business questions from extremely large relational databases. With more than 40 customers in common, it was surprising to many that it took so long to reach a formal OEM agreement.The initial suggestion for a deal came from Sanju and it was for a $5M pre-pay. This did not sit well with me and after 3 years, I knew where all the skeletons and opportunities lay at NCR and felt that there was far greater potential for an accretive deal.

With Sanju on vacation in India the following week, I used the opportunity to pull together an outstanding group of MicroStrategy sales VP’s, Steve Foley, Ray Tacoma and Dan Shoemaker, with MicroStrategy CEO Mike Saylor for a big-deal brainstorming session. I briefed the group on the potential pieces to a deal and the objective was to build a deal-engine with a bunch of levers that we could both manipulate in order to find a best-fit deal.

It was July 1999, the Dot.com boom was accelerating toward its zenith and the landscape for an OEM partnership deal was as follows: -

- NCR Teradata owned the lion's share of the high-end retail data warehouse market and still do today. Teradata was omnipresent in the World’s largest data warehouses in the retail, telco, airline reservations and financial services markets.

- NCR believed they needed dot.com references for their Teradata data warehouses.

- MicroStrategy had just released MSTR7 and for the first time, had a strong product suited for VAR’s and OEM’s.

- The 3-year NCR Teracube development effort was proving technically challenging and was still not reference-able.

- MicroStrategy had IPO’ed a year earlier at an offer price of $12 and a year later the stock had doubled. In the heady days of the bubble, a joint marketing agreement or press release for a new customer announcement would cause the stock to move up a dollar. We knew we were in a bubble… this was a once in a lifetime opportunity.

- Every full-time MicroStrategy employee was an MSTR stockholder and there was a tremendous sense of destiny in the future greatness of the company. CEO Mike Saylor’s vision was well understood and we drank the cool-aid - as well as a lot of alcohol on the MicroStrategy cruise every year.

- Mark Hurd, was NCR’s dealmaker and SVP of the national solutions group. Mark Hurd is a great salesman and he loves doing deals…. (I bet HP wishes they had him back).

Big Deals Have their Own Momentum

It was almost 90 days exactly from the Rocky Blanton meeting, until the MSTR-NCR OEM agreement was signed. If you have ever been surfing you will know that you have to put yourself in the right position in the swell to catch the break and then paddle like hell to get up on the wave. Once you are on it, it’s a fast ride with tremendous momentum, it’s exhilarating, exhausting and requires total focus.The first change in the relationship as we started to work on a deal was the appointment of an experienced hand in Tom Crooke to run the NCR side of the deal. Our deal team consisted of myself, Sanju, Mike Saylor, CFO Mark Lynch and our legal counsel, Adam Ruttenberg, with Dan Shoemaker running the scenarios.

Once we had identified all of the deal elements in our deal engine, the roles changed and I became a supporting player as the executive teams on both sides took over structuring and negotiating the deal through a series of increasingly significant meetings in Dayton OH., and over the phone, culminating in the NCR-Teradata – MicroStrategy OEM partnership.

Success has a Thousand Fathers, Failure is an Orphan

Just over 3 months earlier, I was an orphan, a failure and a waste of 3-years investment and had been given my marching orders with 30 days notice. How sweet the savor of success, after having tasted defeat.The NCR-Teradata - MicroStrategy partnership was structured as follows;

- NCR signed a $27.5 million, 3 year OEM agreement for MicroStrategy’s entire suite of Intelligent E-Business™ products and services,

- MicroStrategy purchased an NCR Teradata Warehouse worth $11 million to power the Strategy.com™ network

- NCR became a master affiliate of Strategy.com

- MicroStrategy agreed to purchase NCR’s TeraCube™ business and all related intellectual property in exchange for $14 million in MicroStrategy stock

There were many people who contributed to the success of the OEM partnership and ongoing business relationship. As I mentioned in the first part of this story, in OEM sales, it’s best to park your ego at the door. It’s a long haul, and when success comes, you will be one of many who contributed.

To be continued in Part 4. Aftermath