Adam Zais is a friend, business partner, new age thinker and practitioner of the new B2B sales and marketing model. We discussed the disruption and sea-change in the traditional sales profession caused by Internet-empower buyer behavior and changes occurring in B2B sales and sales in general in a recent blog article about a landmark OEM deal between NCR and MicroStrategy, under the Subheading of "

The Disintermediation of B2B Sales Professionals"

This article gained positive comments from industry heavyweights and the essence of Adam's argument was echoed in the Corporate Executive Board's main blog last week, entitled

"10 Trends Every Sales Exec Must Know For 2013" This is an important article and worth reading. We have further comments to make to bring the CEB points to life and include the original paragraph and our commentary. Points 2,3,4 are excerpts from the original.

2. Sales culture gets an overhaul.

We can claim this because we are currently

studying it, intensely at that. Anecdotally, we’ve seen that organizations heavily invested in driving new selling behaviors through the traditional means of training, coaching, and hiring are seeing some gains but those are often short-lived. The investments these organizations make in driving a new sales behavior are for naught without the right (and, we believe, very different from most) cultural foundation.

It’d be a cliché to say that sales culture matters when driving substantial transformation. But when you pry beyond the idea and accepted importance

of sales culture, you find little evidence or understanding of what this really means. Social science that can help sales leaders better understand what

good sales culture and

good social norms look like in today’s selling environment simply

does not exist. Frankly, our data is suggesting most sales organizations embodying a cultural profile that overly emphasizes compensation, individual contribution, and near-term outcomes.

We think those cultural norms are a distant cry from what today’s best sales organization should embody. Stay tuned as we have more to come on that front… For our member organizations, be sure to participate in the

2013 Sales Culture and Transformation Survey to understand the cultural profile of your sales organization, and how that is helping or harming your efforts to sell to today’s highly informed customer.

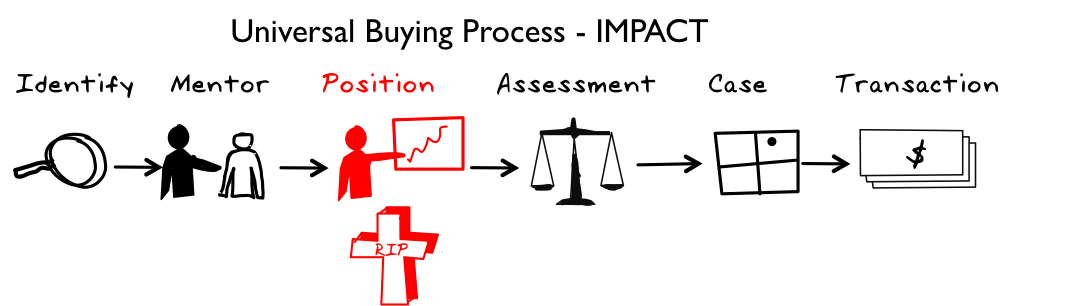

RIP Glengarry Glenross

The culture is broken because the traditional means of training, coaching, and hiring are broken. No other operational area of a business worships such icons as the movie “Glengarry Glen Ross”, fondly repeats clichés like “dialing for dollars” and “sales is a numbers game”, routinely gets away with celebrating reaching 80% of their goal.

We agree that models of good sales culture and good social norms in sales organization do not exist. And yes, that most sales organizations embodying a cultural profile that overly emphasizes compensation, individual contribution, and near-term outcomes are critical problems that lead to severely compromised performance, results, job satisfaction, etc.

The fundamental roadblock to driving new sales behaviors and embracing new cultural foundations are very people who should be the agents of this change - today’s sales leaders. They are stubborn, entrenched, selfish, and powerful guardians of the status quo. They, and the ideas that they espouse, stand squarely in the way of a better future for the profession and for the fortunes of their organizations.

Stop the madness...we need drastically new sales training, we need to stop hiring the “Alec Baldwins” (e.g., manipulative, ‘roid rage psychos, lying-cheating-greedy-egocentric types) into sales, we need to sweep out the current crop of sales leaders who have their heads in the sand.

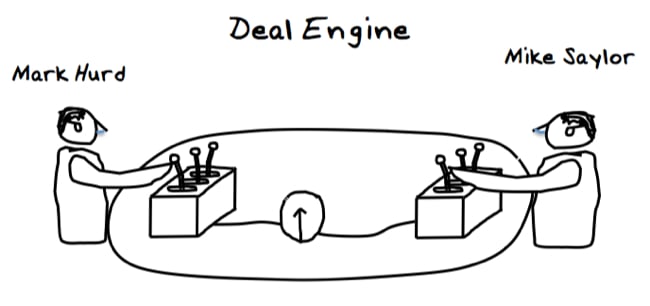

3. Individual performance takes backseat to network performance.

Closely related to trend #2, we believe a fundamentally new organizational dynamic will drive sales productivity – and it’s

not based on making individual reps more effective in their sales-related tasks. This trend is based on research our sister team at the Corporate Leadership Council spent the better part of this year conducting. Their publically available

research summary is a

must read. The punch line of their research is that peak organizational productivity is driven by both:

- individual task performance: an employee’s effectiveness at achieving individual tasks and outcomes, as well as

- network performance: an employee’s effectiveness at improving others’ performance and using others’ contributions to improve his or her own performance

Network performance spans well beyond collaborative online portals and knowledge management platforms – it’s literally the informal networks that answer the question “how does work really get done around here?” And here’s the kicker: network performance is drastically underrepresented in most organizations despite its importance nearly doubling in the past 10 years.

In fact,

firms that were able to proper balance network and individual performance saw a 10% improvement in profitability. This underscores how important the creation of not just formal, but informal networks within your sales organization is becoming.

In sales environments, CEB suggests that the “right balance” is closer to 44:56 in favor of individual versus network performance. Most sales organizations, however, are nowhere near that ratio, drastically over-representing individual performance.

A Sales Team is an Oxymoron

It’s about freakin’ time that this issue is addressed. The sooner we embrace the fact that there is no such thing as a “sales team”, the sooner we can begin the process of healing and change.

Here’s the visual: sled dog team vs. sled cat team

Sales leaders LOVE to use sports analogies to describe sales & sales management. And football tops the list. The problem is that these analogies usually feature the quarterback as the model. We would be far better off if the offensive lineman became the model instead. These guys are the “poster-boys” of balancing:

- individual task performance: an employee’s effectiveness at achieving individual tasks and outcomes, as well as

- network performance: an employee’s effectiveness at improving others’ performance and using others’ contributions to improve his or her own performance

4. Sales comp gets an overhaul.

Related to both trends #1 and #2, we believe the backbone of most sales organizations – the comp plan – is drastically outdated for today’s sales environment.

Team performance, information sharing, collaboration and peer support are being forsaken at the cost of driving individual rep productivity. Our good friend and member – Mitch Little, Head of Sales at Microchip – is

moving aggressively on this idea and has shifted sales compensation away from the traditional quarterly incentives, highly-variable comp model towards a team performance model that resembles traditional salaried positions.

And Mitch isn’t alone. In fact, I’d say one of the most common questions we’ve been getting from our most progressive heads of sales is on this very topic. I

don’t think we are prepared to proclaim an end to the coin-operated era in sales, but all the evidence and research in the space of human motivation sure does signal that comp design needs to be revisited, and not just to tweak it, but to potentially overhaul it.

This is another trend for our members to stay tuned to as both our team and our sister council, the Corporate Leadership Council for Compensation, further research the implications.

Money, Money, Money

It always comes down to money and this is clarion call that harks many people into sales in the first place. Today’s commission-heavy comp plans and other current incentives (spiffs, President's Clubs) are worse than just drastically outdated for today’s sales environment. They are wasteful, divisive, and discouraging. Most (if not all) comp plans merely give lip-service to concepts like team performance, information sharing, collaboration and peer support.

And “achievement clubs” do far more damage to an organization than promote achievement.