The following is a true story. A few names have been changed to protect the identity of some of the people involved.

In the first episode of this story, Scorched Earth, I described the situation leading to my being hired at MicroStrategy into an OEM sales role and the problems in overcoming relationships that my predecessor had soured.

In the second episode, 'Defeat", I explored the changing fortunes of B2B sales professionals, and I described the events leading up to my being given 30 days' notice of termination. This article covers the 90-day lifecycle of the deal itself.

Finding a Champion

Much has been written in B2B sales literature around the need to find a champion for your cause inside the company you are trying to engage. A champion can take you to the top of the organisation, influence strategy, engage decision-makers, acquire funding and make things happen in weeks that could take years or may never happen without their support.

You will recall it had taken more me than 2 years to overcome the scorched earth from my predecessor, execute the joint marketing agreement that led to the value-added reseller agreement, which led to a couple of 7 figure NCR-Teradata-MicroStrategy sales to major US retailers that saved me at the 11th hour from being fired.

Everything before the pivotal meeting with NCR-Teradata in Vienna, VA., in mid-1999 can be described as grunt work, relationship building, influence building, and intelligence gathering.

Selling to a major corporation in B2B or partnering with a major technology company in an OEM role is like orchestrating a chess game. There is lots of activity with pawns, but nothing of consequence happens without engaging the significant pieces. When Rocky Blanton attended our mid-year NCR-Teradata briefing, I knew we had found our major piece, a “Queen” to champion our cause.

Rocky Blanton was VP of sales and a senior member of the NCR retail team - he was also on the NCR-Teradata strategy committee. At our meeting, we reviewed our initial joint success with major retailers and discussed the pipeline of opportunities and the future technology roadmap for MicroStrategy products. During the strategy discussion, Rocky revealed an interest in moving our partnership to the next level, - OEM.

I remember the excitement as we took a break in our meeting, and I ran down the hall and burst into MicroStrategy COO Sanju Bansal’s office to tell him the news.

Finding a Deal

The OEM partnership potential between NCR Teradata and MicroStrategy was obvious, even for our customers. The combined toolset was ideal for customers wanting to get answers to SKU–level business questions from extremely large relational databases. With more than 40 customers in common, it was surprising to many that it took so long to reach a formal OEM agreement.

The initial suggestion for a deal came from Sanju, and it was for a $5M pre-pay. This did not sit well with me, and after 3 years, I knew where all the skeletons and opportunities lay at NCR and felt that there was far greater potential for an accretive deal.

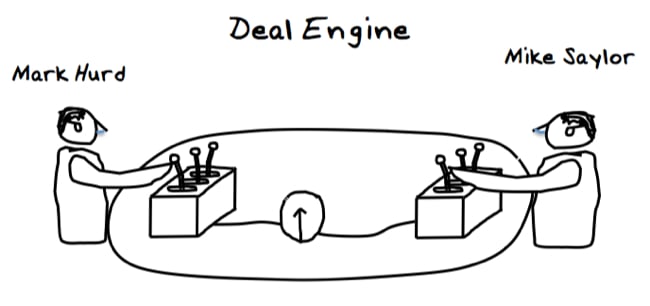

With Sanju on vacation in India the following week, I used the opportunity to pull together an outstanding group of MicroStrategy sales VP’s, Steve Foley, Ray Tacoma and Dan Shoemaker, with MicroStrategy CEO Mike Saylor for a big-deal brainstorming session. I briefed the group on the potential pieces to a deal, and the objective was to build a deal engine with a bunch of levers that we could both manipulate to find a best-fit deal.

It was July 1999, the Dot.com boom was accelerating toward its zenith, and the landscape for an OEM partnership deal was as follows: -

- NCR Teradata owned the lion's share of the high-end retail data warehouse market and still does today. Teradata was omnipresent in the World’s most extensive data warehouses in the retail, telco, airline reservations and financial services markets.

- NCR believed they needed dot.com references for their Teradata data warehouses.

- MicroStrategy has just released MSTR7, which includes APIs, SDKs, and well-documented code, making it an ideal product for VARs and OEMs.

- The 3-year NCR Teracube development effort proved technically challenging and was still not reference-able.

- MicroStrategy had IPO’ed a year earlier at an offer price of $12, and a year later, the stock had doubled. In the heady days of the dot-com bubble, a joint marketing agreement or press release announcing a new customer would cause the stock to move up a dollar. We knew we were in a bubble…, but this was a once-in-a-lifetime opportunity.

- Every full-time MicroStrategy employee was an MSTR stockholder, and there was a tremendous sense of destiny in the future greatness of the company. CEO Mike Saylor’s vision was well understood, and we drank the cool-aid and much alcohol on the MicroStrategy cruise every year.

- The late Mark Hurd was NCR’s dealmaker and SVP of the national solutions group. He was a great salesman and loved doing deals…. (I bet HP wished they had not let him go.)

Big Deals Have their Momentum

It was almost 90 days from the Rocky Blanton meeting until the MSTR-NCR OEM agreement was signed. If you have ever been surfing, you will know that you must put yourself in the correct position in the swell to catch the break and then paddle like hell to get up on the wave. Once you are on it, it’s a fast ride with tremendous momentum; it’s exhilarating, exhausting and requires total focus.

The first change in the relationship as we started to work on a deal was the appointment of an experienced director, Tom Crooke, to run the NCR side. Our deal team consisted of myself, Sanju, Mike Saylor, CFO Mark Lynch, and our legal counsel, Adam Ruttenberg. Dan Shoemaker ran the scenarios.

Once we had identified all of the deal elements in our deal engine, the roles changed, and I became a supporting player as the executive teams on both sides took over structuring and negotiating the deal through a series of increasingly significant meetings in Dayton OH., and over the phone, culminating in the NCR-Teradata – MicroStrategy OEM partnership.

Success has a Thousand Fathers, Failure is an Orphan

Just over three months earlier, I was an orphan, a failure, and a waste of three years of investment. I had been given my marching orders with 30 days' notice. How sweet the savour of success after having tasted defeat.

The NCR-Teradata - MicroStrategy partnership was structured as follows;

- NCR signed a $27.5 million, 3-year OEM agreement for MicroStrategy’s entire suite of Intelligent E-Business™ products and services,

- MicroStrategy purchased an NCR Teradata Warehouse worth $11 million to power the Strategy.com™ network

- NCR became a master affiliate of Strategy.com

- MicroStrategy agreed to purchase NCR’s TeraCube™ business and all related intellectual property in exchange for $14 million in MicroStrategy stock

The partnership with NCR Teradata was the most successful of all of MicroStrategy’s reseller partnerships, and they sold through their entire $27.5M commitment.

Many people contributed to the success of the OEM partnership and ongoing business relationship. As I mentioned in the first part of this story, it’s best to park your ego at the door in OEM sales. It’s a long haul, and when success comes, you will be one of many who contributed.

To be continued in Part 4. Aftermath