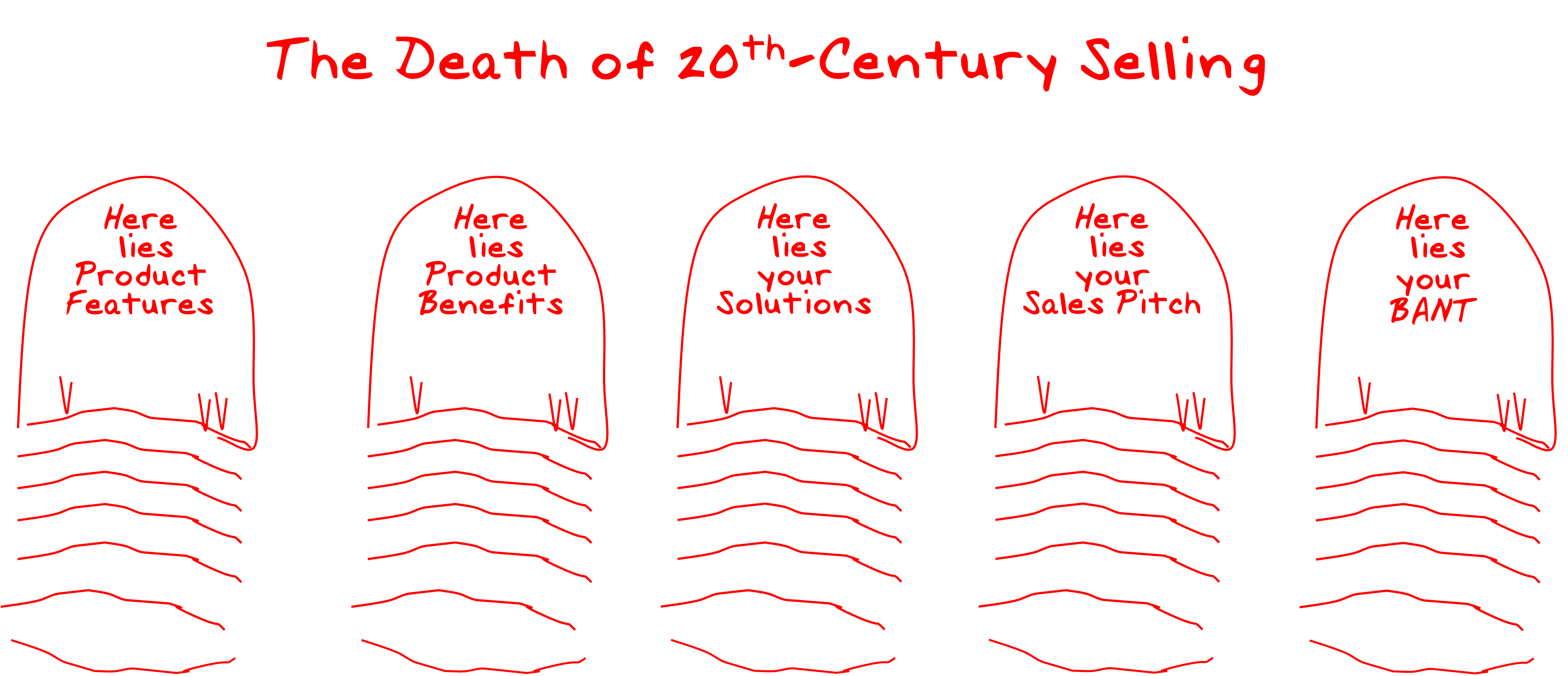

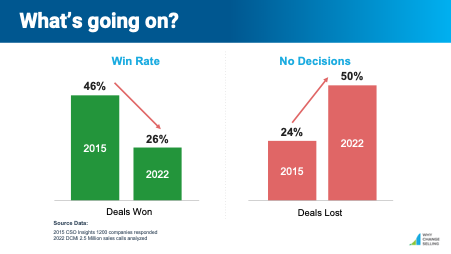

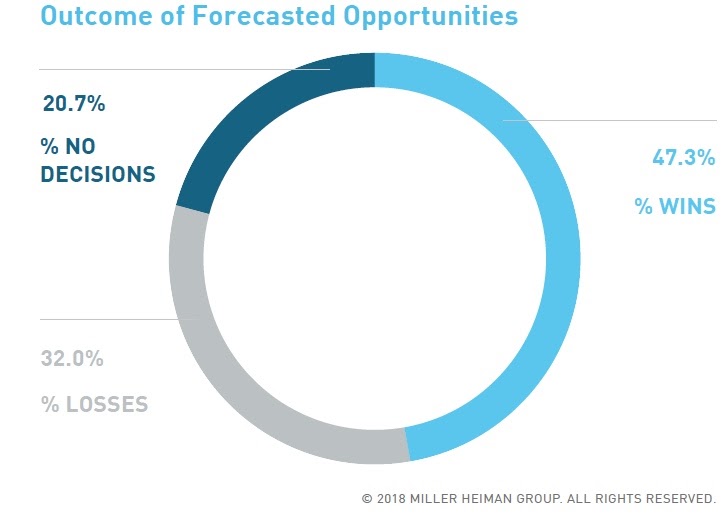

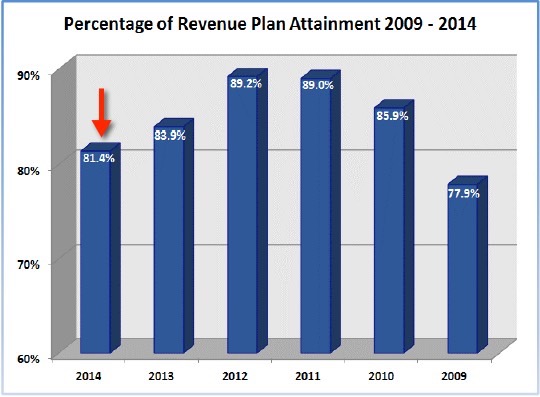

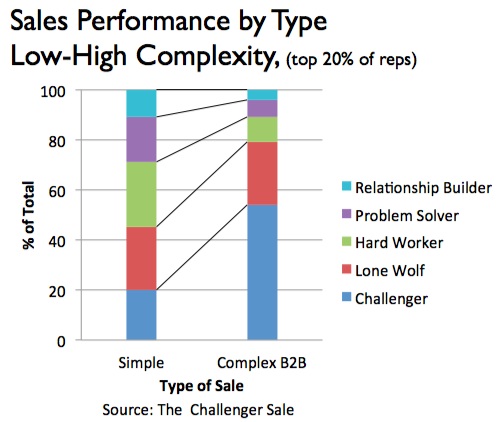

B2B Sales people are struggling with only 58% of B2B reps making quota in 2015. This problem is getting worse as fewer salespeople are able to make their numbers. Is it because they are weaker than in the past, or is it because the market has changed? The Corporate Executive Board (CEB) has been studying sales performance in depth for the past 4 years and the conclusion is that there is a permanent change in the way people buy and and the old models of selling are no longer effective.

This is the second part of the CEB article published several weeks ago, entitled

"10 Trends Every Sales Exec Must Know For 2013"

This is an important article and worth reading. The remaining 5 points excerpted for our discussion below, were published in this article on the CEB main blog,

The Last 5 Trends Every Sales Exec Must Know for 2013.

The key insights in this current article:

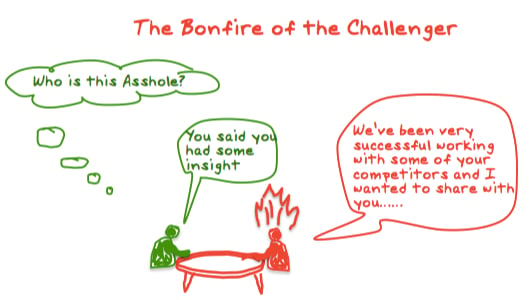

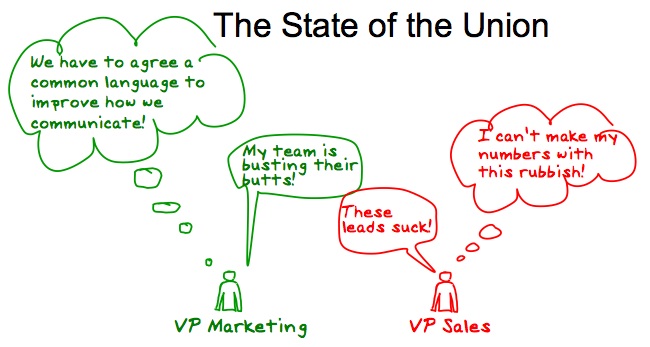

6. Your customer becomes your biggest competition.

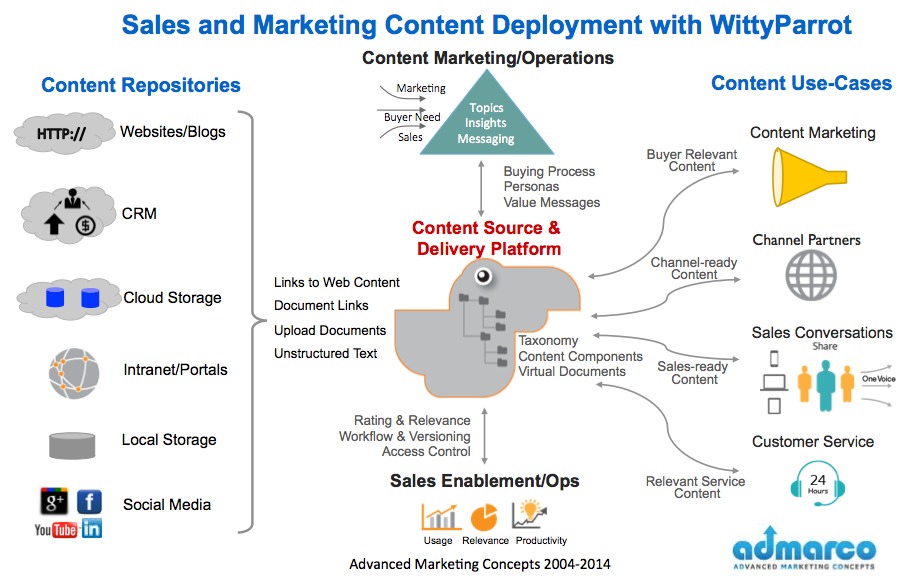

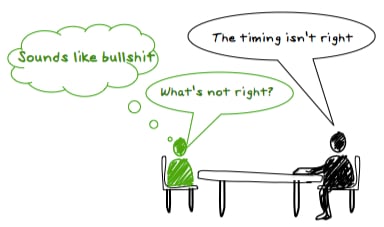

More specifically, your customer’s ability to learn what their business needs are, and options to act on those needs. We call this the “1 in 3” problem and here’s why: customers that are now able to learn on their own (or with a consultant’s support) are also able to arrive at a requirement set without supplier input. For example, they dictate the uptime requirements, the performance thresholds, the expected SLA's, and other criteria. They winnow a list of potential suppliers down to the top 3 that best meet these performance thresholds. Then they call you in to present. Congrats you’re in the consideration set! And so what do you do? You highlight your performance against their criteria. “Well we see that you require 95% uptime, we can deliver

98%. And we see that you need 30,000 units output, but our innovative technology delivers

33,000.” To which the customer replies, “yes, we already know that, but we only need 95% uptime and 30,000 units output, and all the companies in consideration deliver

that. So……let’s talk price.” In this world, consideration equals commoditization. There are two vitally important takeaways from this trend:

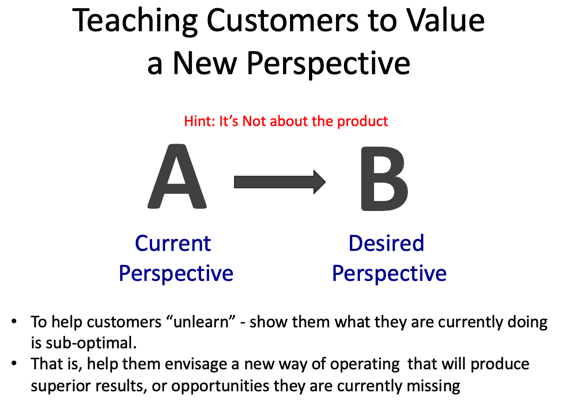

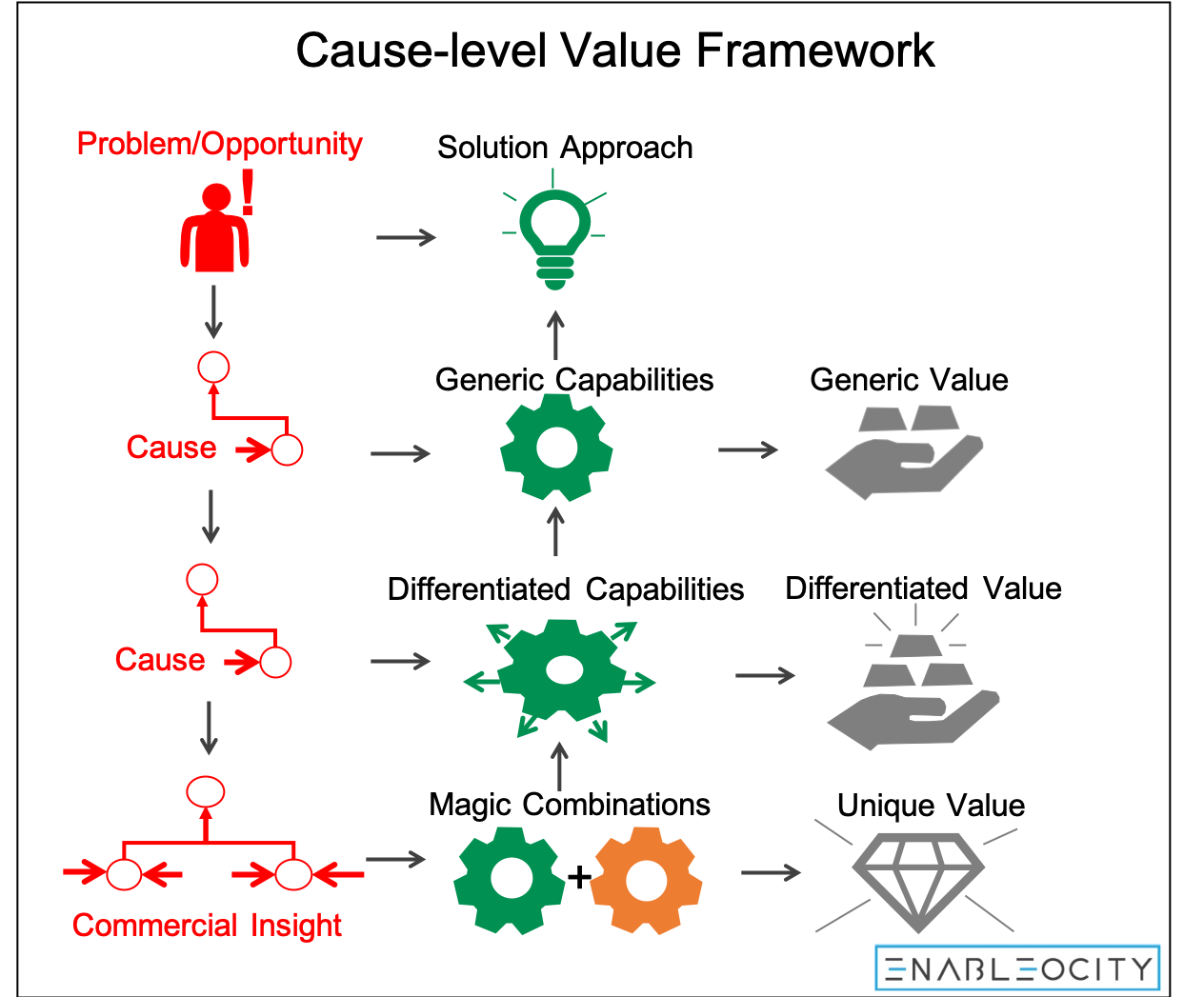

First, this underscores why the Insight Selling Method™ is so important. Insights which you can teach customers

are differentiated, and have the ability revise the purchase criteria, mitigating the “1 in 3” problem. I’ve discussed this in trend #1 and my colleague Brent Adamson has explored this challenge extensively

here (this is another must read once you’ve finished this post).

Second, this highlights how the customer has taken this new information advantage and used it (as they should) to their benefit. If they can rely on social networks and third party consultants to force us into a price war, they’d be foolish

not to do that.

We are losing this information game to customers.

The best sellers, however, are taking this information disparity right back to customers. Our data shows us that the best reps are conducting deep opportunity/account due diligence with one specific goal:

learn something about customers that the customers themselves haven’t realized. This isn’t information in the public filing statement, annual review, or company website.

This is information that exists in the deep inner workings of customer organizations. Information that “Talkers” dish out. Information that purchase consultants divulge. [NOTE: This is NOT unethical information or insider secrets.] It is a much deeper understanding of what’s happening in the customer business that often

requires outside intervention to even realize. When this context is combined with powerful insights, customers have little choice but to at least listen and learn from suppliers. And

that mitigates the “1 in 3” challenge. Sellers who choose to arbitrarily “spray” insights at customers risk harming the relationship permanently, but those who properly tailor those insights in a meaningful and economically-grounded ways will beat the “1 in 3” problem.

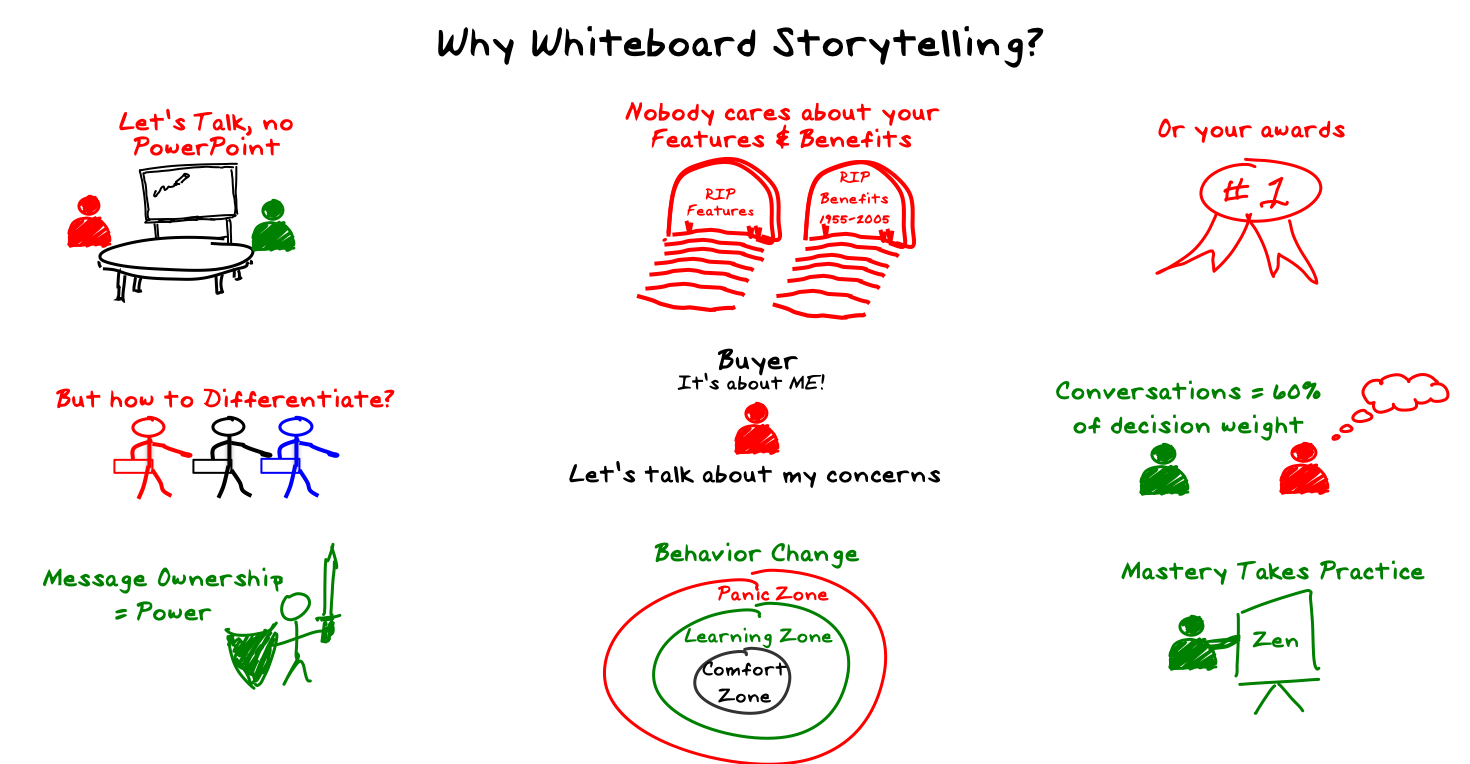

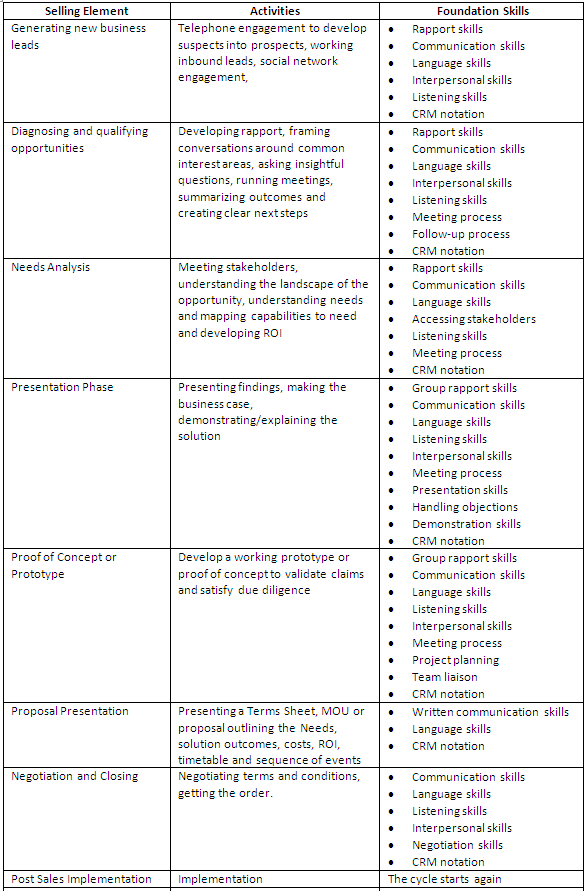

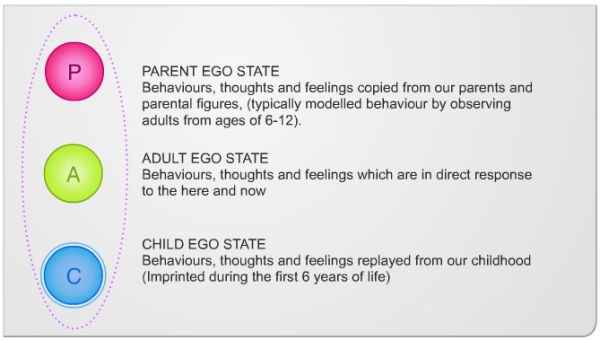

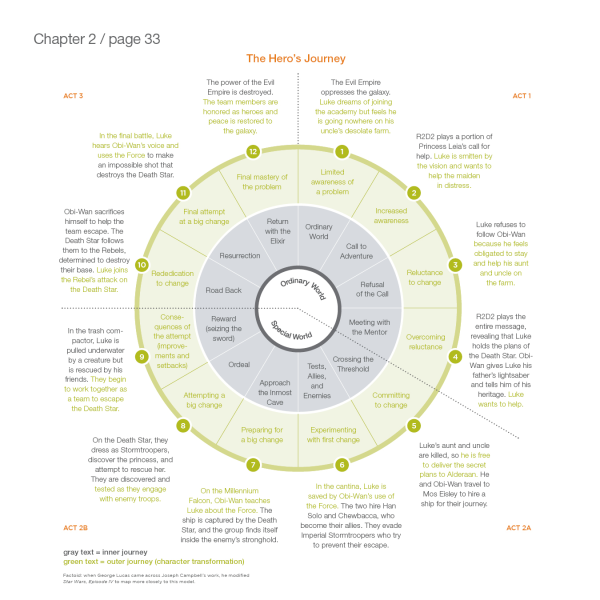

Salespeople in the future will behave more like consultants

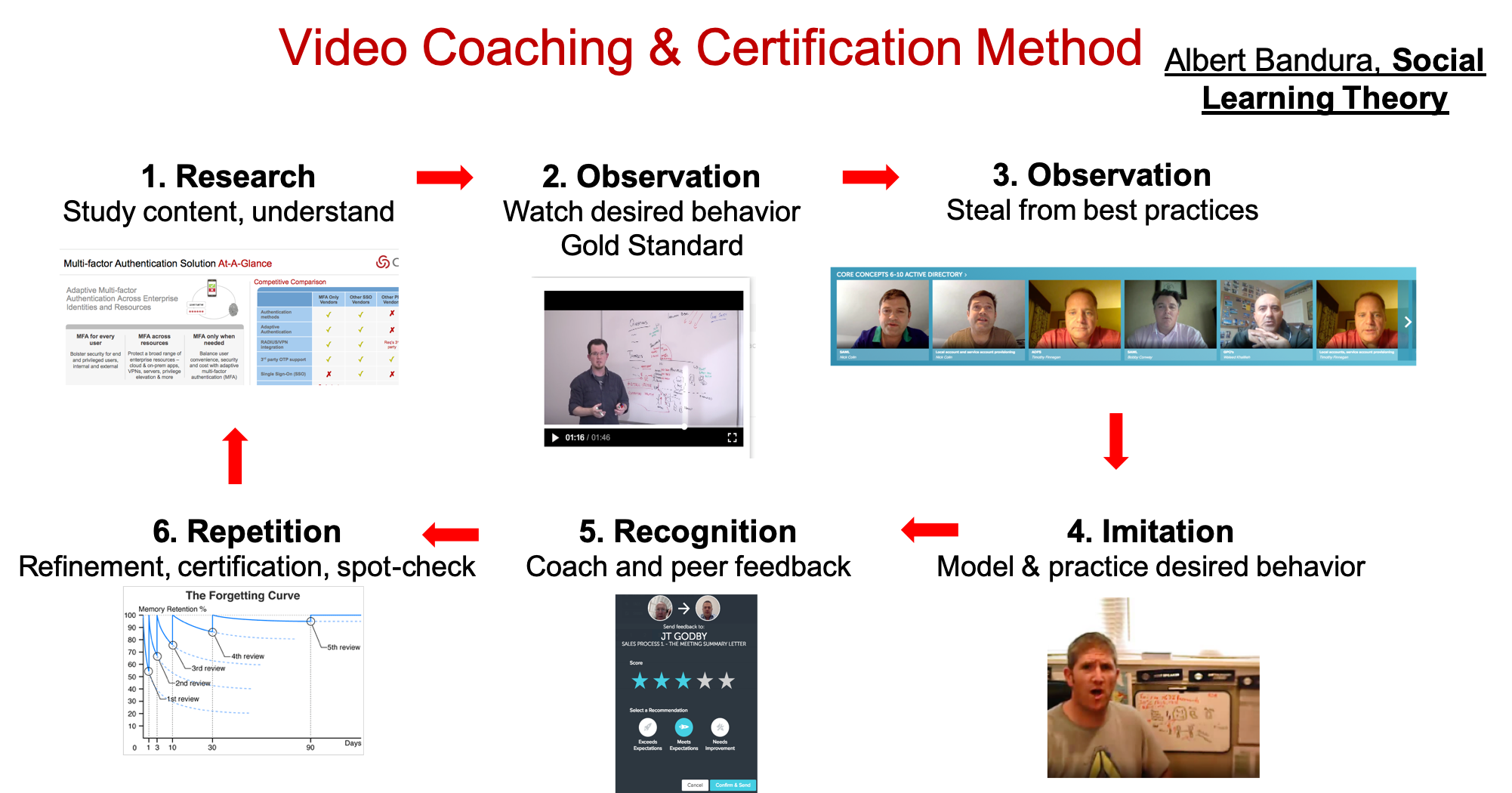

We have heard and seen plenty of horror stories of sales reps spraying insights that have no relevance to the problems or goals of the customer or their organization. This is just poor preparation and poor technique. Challenger or not, these reps are on the path to exiting the profession without coaching, new tools, techniques and behavior change.

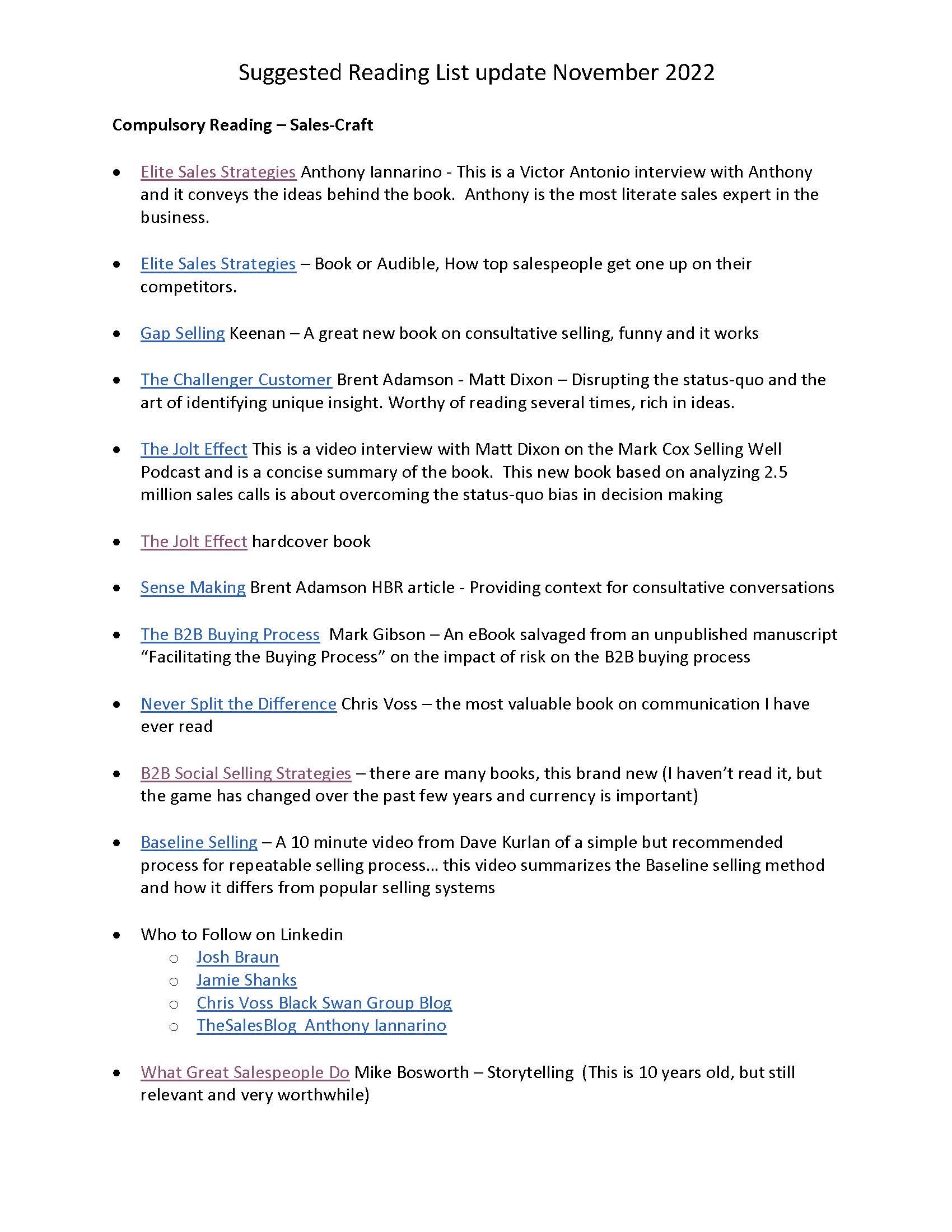

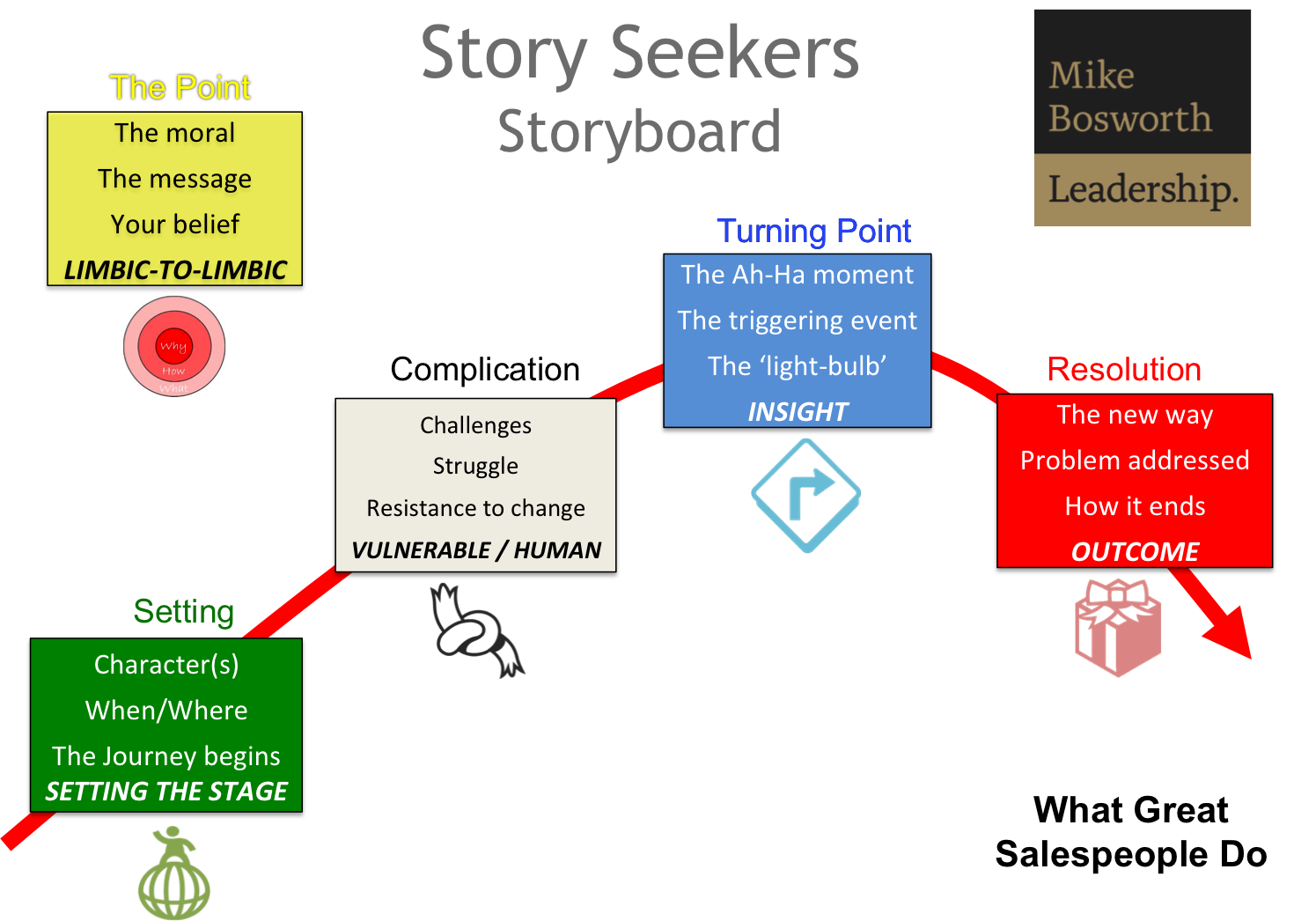

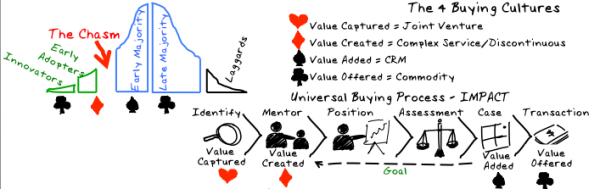

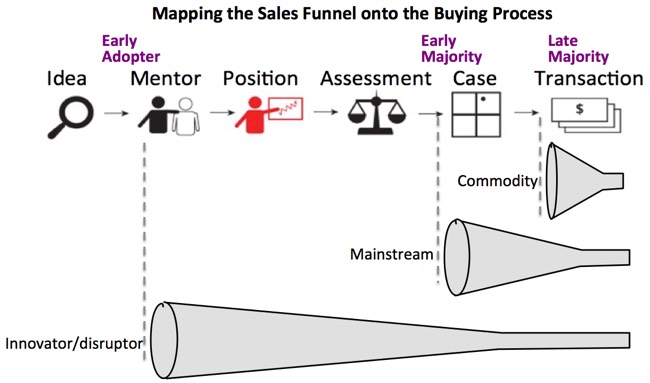

True insights require deep knowledge of the customers business that cannot be easily derived from public sources....it has to come from within. This means due diligence could take weeks - instead of a few hours prior to a sales call with a key executive. Sourcing insightful information from peers, outsiders, former employees, underlings and even corporate purchasing....anyone that could help give you insight. Dominic Rowsell refers to this as a "deep-dive into the World of the buyer" in his book

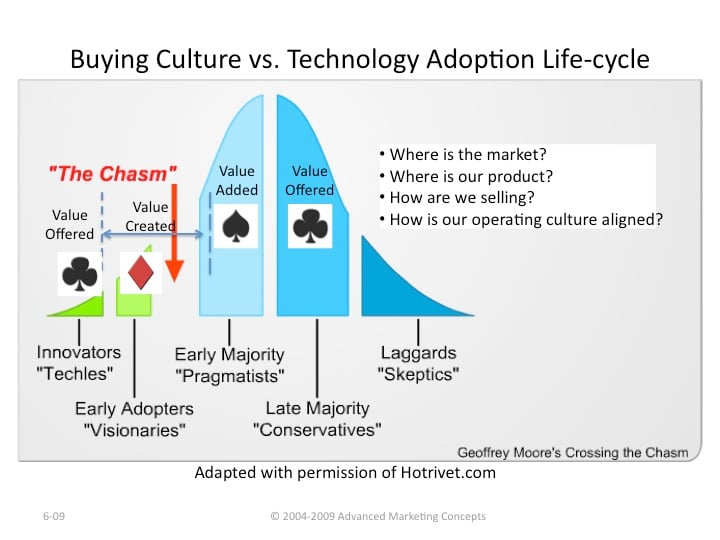

Why Killer Product's Don't Sell, which analyzes the new buyer behavior and defines

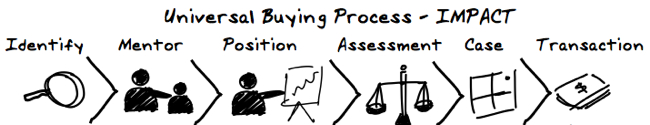

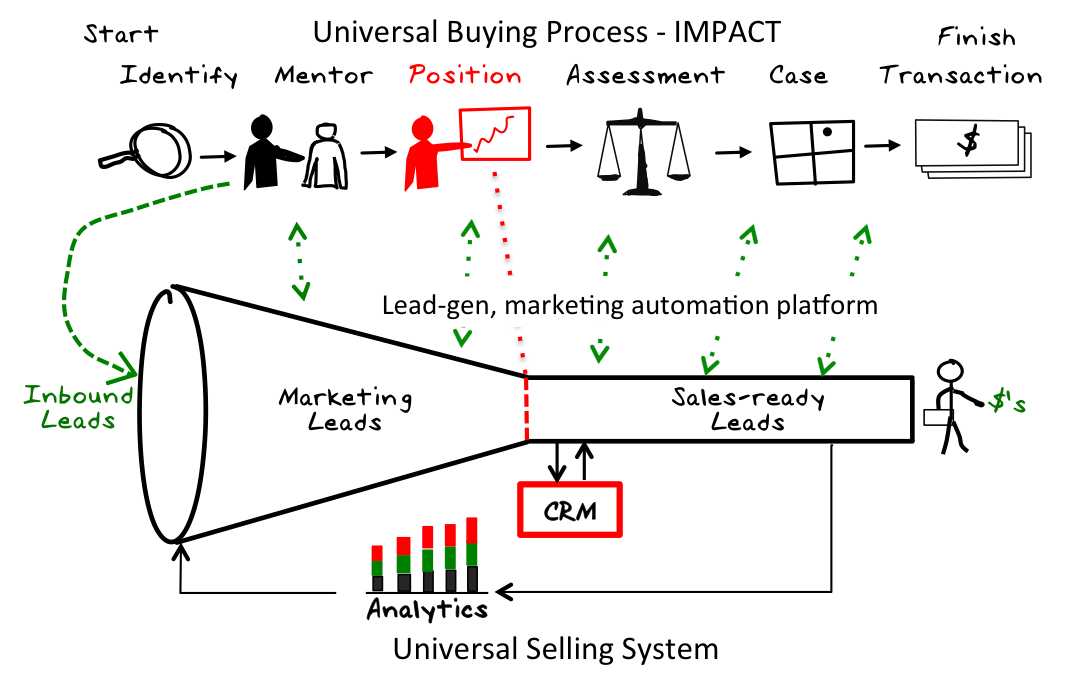

value-created selling as the way to engage buyers early in the buying cycle, when they may be unaware of the opportunity or are researching directions, ideas and risks in the Identify and Mentor phases of the IMPACT buying cycle.

Value Created Selling Definition: The supplier reveals unforeseen risk or opportunity for the customer (thus creating new value for them) and will assume some kind of responsibility to realize the return.